Nexo is a popular crypto lending platform that offers a range of financial services to its customers, including its Instant Crypto Credit Lines. It doesn’t offer traditional lump-sum loans but rather credit lines you can withdraw from at any time for any purpose, though they are collateralized the same as any other crypto loan.

Here’s what you should know before considering a credit line from Nexo.

1. You Can Borrow Anywhere From $50 to $2M, Currency Dependent

Nexo offers credit lines in a range of different amounts, with the minimum and maximum loan amount varying depending on the type of collateral used.

For Bitcoin (BTC), the minimum loan amount is $500, while the maximum loan amount is $10 million. For Ethereum (ETH), the minimum loan amount is $500, while the maximum loan amount is $5 million. Other cryptocurrencies, such as Litecoin (LTC), Ripple (XRP), and Bitcoin Cash (BCH), have higher minimum loan amounts, ranging from $100,000 to $2 million.

LTV

20% - 50%

APR

0%+

FEES

$0 Origination Fee

- Instant approval

- No paperwork to fill out

- No impact on your credit score

- Users cite being margin called and liquidated during volatility

The loan-to-value (LTV) ratio, which is the amount of the loan compared to the value of the collateral, also varies depending on the type of collateral used. For example, for BTC collateral, the LTV ratio can range from 20% to 50%, depending on the loan amount. The higher the LTV ratio, the more risk the borrower is taking on, so Nexo typically charges higher interest rates for higher LTV ratios.

Overall, Nexo offers a range of credit line amounts to suit the needs of different borrowers, with higher amounts available for those who have more valuable cryptocurrency holdings. However, it is important to note that borrowers should always consider the risks and costs involved in using their cryptocurrency as collateral before taking out a loan.

2. Your Interest Rate Depends on Your Loyalty Tier

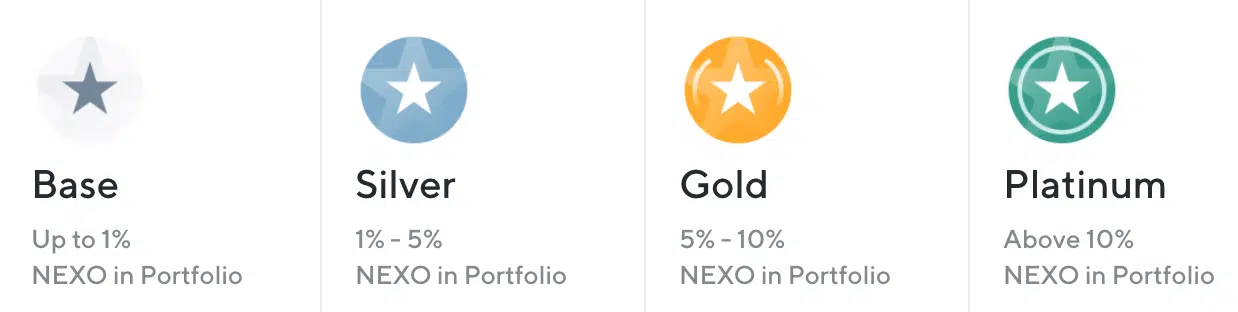

One of the unique features of Nexo is its loyalty program, which rewards users for their continued use of the platform. The loyalty program is based on a tiered system, with users able to move up tiers by meeting certain criteria. There are four tiers in total: Base, Silver, Gold, and Platinum.

The Base tier is the starting point for all Nexo users, and it offers a range of benefits such as one free withdrawal per month, 24/7 customer support, and access to the Nexo mobile app.

The Silver tier is unlocked when users’ portfolios consist of at least 1% of Nexo tokens. This tier offers additional benefits such as a .25% Nexo bonus, higher yields, reduced borrowing rates, and two free withdrawals per month.

The Gold tier is unlocked when users’ portfolios exceed 5% of Nexo tokens. It offers a 1% Nexo bonus and three free monthly withdrawals.

Finally, the Platinum tier is unlocked when a user’s portfolio exceeds 10% Nexo tokens. This tier offers the most benefits, including a 2% Nexo bonus interest rate on all fiat deposits, a dedicated account manager, five free monthly withdrawals, and exclusive access to new Nexo features and services.

3. You Can Withdraw Funds Repeatedly Like a Revolving Credit Card

As we’ve already pointed out, Nexo offers loans akin to a credit card rather than a traditional loan. You can borrow and repay over time just as you would a revolving credit account, rather than make monthly payments until what you borrowed is paid off.

The borrowed funds can be used for any purpose, such as buying additional cryptocurrency or making other investments. Borrowers can choose to repay the loan either in fiat currency or cryptocurrency, and they can make repayments at any time without penalty.

Nexo says that “The Instant Crypto Credit Lines™ allow you to withdraw as much or as little as you want, whenever you want. Additionally, you are only charged interest on the sum you withdraw, giving you greater flexibility to manage your credit as you go and pay as little or as much in interest as you decide.”

This format provides greater flexibility for tapping into your crypto when you need to at low-cost borrowing rates.

4. You Must Transfer More Crypto or Fiat If Your Collateral’s Value Significantly Decreases

As with all crypto lending platforms, it’s important to note that Nexo requires borrowers to maintain a minimum LTV ratio to ensure that they have sufficient collateral to cover the loan. A margin call is a warning from Nexo that the borrower’s collateral has fallen below the minimum loan-to-value (LTV) ratio required by the platform. If the value of the collateral falls too low, Nexo may initiate a margin call to protect itself from losses.

If a margin call is initiated, the borrower will be notified and given a certain amount of time to either deposit more collateral or repay some of the loan to increase the LTV ratio. If the borrower fails to take action within the specified time period, Nexo may liquidate some or all of the collateral to recover the outstanding loan amount.

The margin call process is designed to protect both the borrower and Nexo from potential losses. By maintaining a minimum LTV ratio, Nexo ensures that there is sufficient collateral to cover the loan amount even if the value of the collateral fluctuates. Additionally, the margin call process gives borrowers an opportunity to rectify the situation before their collateral is liquidated.

It is important to note that margin calls can occur in volatile market conditions, where the value of cryptocurrency can fluctuate rapidly. Borrowers should always ensure that they have sufficient collateral to cover the loan amount and maintain a comfortable margin of safety to avoid the risk of margin calls. Additionally, borrowers should monitor their loan account regularly to ensure that their collateral remains above the minimum LTV ratio required by Nexo.

5. There’s No Credit Check

Most crypto companies preach about greater borrowing access for underserved populations, Nexo included. That’s because all crypto loans (or credit lines) are secured by a borrower’s collateral. That means there’s no credit or income check to qualify for an instant credit line—you just need to provide sufficient collateral.

To bring quality credit and banking services to the underbanked and unbanked, Nexo eliminated credit scores as a criterion for lending. We did this through collateralized lending: by using crypto as collateral, we bypass the risk of loan defaults. Should a borrower fail to repay their credit line, the company can compensate for the loss by selling their collateralized crypto. This leaves no need to use credit scores to determine creditworthiness and allows all Nexo clients to take out any amount against the necessary collateral. – Nexo

This also means the approval process is typically faster and more straightforward than traditional credit products that require a credit check and other documentation.

In Sum

A Nexo credit line can be a good idea for several reasons, including instant access to funds, no credit check, competitive interest rates, flexible repayments options, and you retain ownership of your crypto.

And while a Nexo credit line can be a useful financial tool for many borrowers, there are some potential downsides to consider, including the risk of volatility, limited LTV ratios and currency options, and potential tax implications.

It’s important to carefully consider the risks and benefits of taking out a Nexo credit line and to understand the terms and conditions of the loan before making a decision. It’s also a good idea to consult a financial professional if you have any questions or concerns about taking out a credit line.