BlockFi filed for bankruptcy in November 2022 and its credit card is no longer available to new applicants.

This BlockFi credit card review will cover everything you want to know about the card’s rewards, fees, approval criteria, benefits, and drawbacks. We’ll dive deep into the card’s terms and conditions so you don’t have to.

Earn 1.5% Back in an Asset of Your Choice

The BlockFi credit card is the undeniable leader when it comes to earning crypto rewards, particularly BTC. The Gemini credit card may give the BlockFi card a run for its money when it becomes publicly available, but it’s been on a waitlist for quite some time now with no real updates as to when it’ll be open to applicants.

Cardholders earn 1.5 reward points for every $1 they spend on the card. BlockFi recently introduced Rewards Flex, which allows cardholders to choose which asset they want to receive rewards in.

Eligible currencies currently include:

- Bitcoin (BTC) – the default reward

- Ether (ETH)

- Litecoin (LTC)

- Chainlink (LINK)

- PAX Gold (PAXG)

- Basic Attention Token (BAT)

- Uniswap (UNI)

Eligible stablecoins include:

- Gemini Dollar (GUSD)

- USD Coin (USDC)

- Paxos Standard (PAX)

- Multi-Collateral Dai (DAI)

- Binance USD (BUSD)

Rewards points are automatically converted on the second Friday of every month. Cardholders can move the earned rewards into a BlockFi Interest Account or withdraw the funds to an external wallet.

You can only elect one asset to earn your rewards in each month, but you can change assets every month to diversify your holdings if you want to. To change your BlockFi Rewards Card currency:

- Sign in to blockfi.com

- Click on ‘Credit Card’ > ‘Rewards’

- In the ‘Manage Rewards’ section, click the dropdown menu under ‘Rewards Currency’

- Select the cryptoasset you want to earn rewards in

You’ll have access to a dashboard that displays your current earnings value, but that value is based on real-time market data, which means the amount will fluctuate with the market and may not equal the amount paid on the redemption date.

As a signup bonus, you’ll earn 3.5% back on all purchases in your first 3 months of card ownership. And any purchases made after spending $50,000 on the card will earn a boosted rate of 2% back.

You’ll also earn an additional $30 in bitcoin for every person you refer who is approved for a new card account. And if you use the BlockFi Trading Account, you’ll earn a 0.25% bitcoin trading bonus–up to a maximum of $500–on all eligible trades just for being a cardmember.

Benefits & Drawbacks of the BlockFi Visa Credit Card

It’s right in the name that the BlockFi Rewards Visa Signature card is a Visa Signature card, which carries its own list of benefits, including but not limited to:

- Zero Liability protection for unauthorized charges

- Travel and emergency assistance services

- Emergency card replacement if yours is lost or stolen

- Auto rental collision damage waiver when you use your card to rent a vehicle

- Lost luggage reimbursement/trip cancellation insurance

- Norton LifeLock ID Theft Protection

- Luxury Hotel Collection, Silvercar rental, Sonoma Wine Country, Troon Golf, and Concierge

According to the BlockFi website:

“On top of the rewards you get from BlockFi, your BlockFi Rewards Visa Signature card gives you instant access to once-in-a-lifetime travel, fine wine and food, sporting events, shopping and more.

- Enjoy special access to unforgettable experiences with your BlockFi Rewards Visa Signature card—from fine wine and food events, luxury hotels and premium car rental service to once-in-a-lifetime sporting events, shopping and more.

- Your BlockFi Rewards Visa Signature card comes with 24/7 access to your Visa Signature® Concierge* for assistance booking travel, transportation, accommodations, event tickets—even restaurant reservations and golf tee times.”

Visa Signature cards offer promotions with new services all the time. BlockFi says it’s adding new benefits soon and to “check back frequently for updates.”

A couple of drawbacks we’ve encountered on Reddit are:

- Doesn’t currently support contactless payments

- Because it’s new it isn’t recognized by all finance apps and trackers yet

- Doesn’t support in-app payments

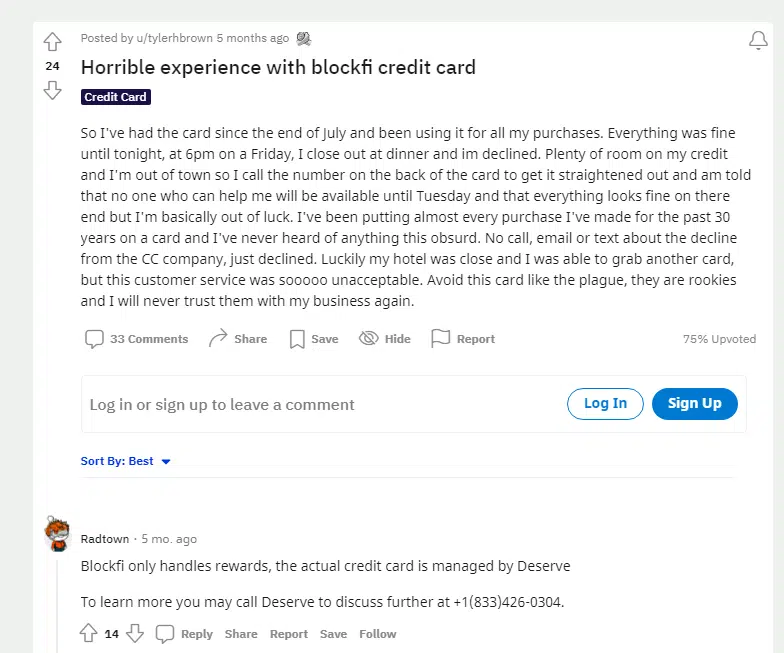

- The issuing bank, Deserve, doesn’t operate on weekends, so if you have a problem with your account on a Saturday, you may have to wait until Monday for any help. Big-bank cards offer 24/7 support.

Luckily, all of these drawbacks (except for the last one) seem temporary. Support says it’s working on an API so the card is recognized by platforms like Mint and supposedly payments within the app are on the way. And it’s hard to imagine they don’t have plans to make this a contactless card in the age of ‘Rona.

Rates and Fees

Here’s the link to the BlockFi Rewards Visa Signature card agreement where you can see all rates and fees charged by the card. But here’s a breakdown of the most important numbers:

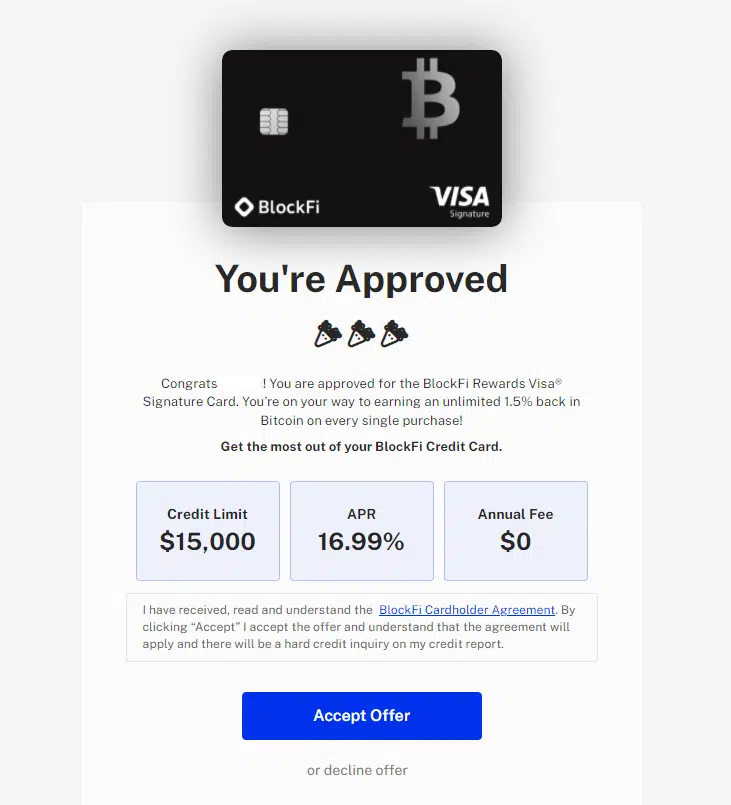

- APR: 14.99% – 24.99% based on creditworthiness, meaning those with higher credit scores will earn the lowest APRs. Note that this card offers an interest-free grace period of 23 days after the close of the billing cycle, which means you have 23 days to pay your balance without having to pay interest on your purchases.

- Annual Fee: $0

- Late Payment Fee: $25

- Returned Payment Fee (insufficient funds): $37

There’s no cash advance fees or cash advance APRs because this card does not permit cash advances. We also couldn’t find mention of a penalty APR in the agreement, which means if you pay late, you may not incur a higher APR as you would with some other cards.The late payment fee is also $15 less than what a card issuer is legally allowed to charge, so that’s nice.

But just because this issuer may be friendlier than others in terms of late payments, paying your bill 30 or more days late is literally the worst thing you can do to your credit score, and could cause it to drop by 100 or more points.

Approval Criteria

The BlockFi Rewards Visa Signature Card requires good to excellent credit to be approved. That generally means a credit score of 670 or higher.

A nice feature of this card is that offers preapproval, which means you can gauge your chances of approval without actually applying. This is beneficial because a credit card denial can negatively affect your credit report and score, whereas a preapproval application doesn’t affect your credit at all.

And if you receive preapproval, it means your odds of being approved for the card are high. But please note that preapproval never guarantees final approval.

The one kind of annoying thing is that BlockFi will require you to create an account before you can fill out the preapproval form. This is true for the real application too, but it makes sense because you need a BlockFi account to own the card and receive your rewards. I just personally think they can do away creating an account for preapproval, but it’s simple enough and doesn’t take long.

Here’s how to get preapproved and apply:

- Click this link

- Click the blue “Get Started” button

- Sign in or fill out the form asking for your first and last name, email address, and password. This is also where you can enter a referral code if a friend referred you to sign up.

- Complete the bot test and verify your email.

- Click the link that was sent to your email and complete the form that requires your personal information, Social Security number, and financial information. Your SSN is only used to conduct a soft pull of your credit that won’t affect your credit score.

- Check the terms and agreement boxes and click the blue “Submit Application” box. You’ll have to wait about a minute or so for BlockFi to process your application.

- Your preapproval decision will come through, and if you’re preapproved, you can choose to accept or decline the offer. You won’t have to fill out a separate application after receiving preapproval.

If you choose to accept the offer, this is when the hard inquiry to your credit report will be done to verify the details you provided. But don’t worry, hard inquiries only minimally affect your credit score by up to 8 points for up to 1 year. And the damage may be offset by the new credit limit you’re offered.

BlockFi Reddit Reviews From Real Cardholders

I always like to dig around the web and see what experiences people are having with the card. Here are some real reviews found on Reddit:

As mentioned above, in-app payments are reportedly on the way.

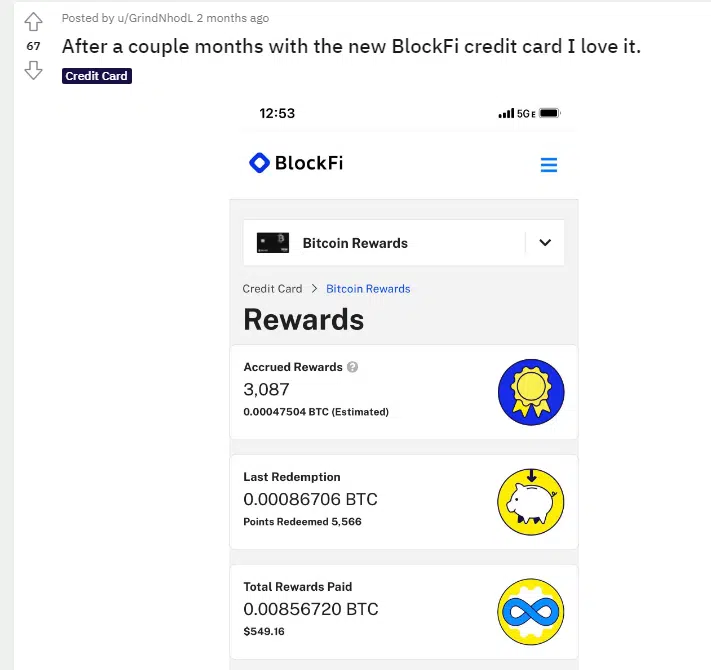

Here’s an example of what one cardholder earned using their card:

Based on 3.5 points per $1 spent in the first 3 months of account opening, this person spent ~$882 to earn $549, which is ridiculously lucrative. Based on the standard 1.5% rate, they spent ~$2,058.

Also mentioned above in the drawbacks is that support may not be available on weekends and holidays, which can cause commotion if you don’t have another card available:

That’s just a sampling of some of the more useful reviews, but you can find a lot more in the r/blockfi community.

Final Thoughts

We’ve found that some people have complaints about the “low” 1.5% rewards rate, but if you’re bullish on bitcoin like we are, you can stack up your earnings in hopes that they’ll far outweigh those of any regular cash back card.

People also claim that big-bank cards offer much more than 1.5% back, but that’s not really true. They may offer up to 5% or 6% back only on select purchases, like dining or fuel. But flat-rate rewards cards, like this one, cap out at about 2% industry wide. And frankly I’d take 1.5% back in bitcoin and hodl it any day over 1.5% USD. But sure, if you’re planning to frequently cash-in your rewards, maybe stick with a card that doesn’t provide volatile rewards.

We think this is a genuinely solid card and wouldn’t recommend it if we didn’t. You can apply for it by using our affiliate link, in which we’ll earn a commission if you’re approved.

If there’s anything we didn’t cover that you’d like to know more about, drop us a line at info@cryptolendingadvice.com.