Please note that BlockFi filed bankruptcy in November 2022 and its products and services are no longer available to new customers.

Blockchain has proven itself as a force for change in almost every established industry. However, itʼs within finance that it seeks to truly make the grade.

The traditional lending industry accounts for a stunning figure when considering the global financial economy. In early 2020, global debt was heading north of $244 trillion. What this dollar amount indicates is that where there are debtors, there are loans.

The extremely high-volume lending sector makes it ripe for blockchain intervention. Cryptocurrency loans and interest accounts have been making big gains over the past two years, especially with services like BlockFi taking up the reins.

BlockFi has built an elegant platform for what it terms crypto wealth management. With BlockFi, you can borrow cash in USD or earn interest on BTC, ETH, LTC, USDC, and PAX with the BlockFi Interest Account (BIA).

Let’s dive into this BlockFi review and the specifics of its loan and interest account offerings.

BlockFi Offers a Suite of Products for Crypto Investors

A major stumbling block in the blockchain industry (no pun intended) is the inability to state offerings in a simple, easy-to-understand manner. Platforms that are basically gambling sites refer to themselves as “predictive search engines” and currencies are “mediums of exchange.”

While the initiated may understand these nuances, those of us just looking for blockchainʼs advantages will probably get lost. BlockFi doesnʼt fall into this trap, which is greatly to its advantage.

Instead, BlockFi makes its premise quite clear—it offers wealth management for digital assets. Within the spectrum of wealth management products, BlockFi offers interest accounts, crypto loans, a new trading platform, and institutional services.

BlockFi Loans

While other services hand out crypto loans that keep users trapped within the digital asset ecosystem, BlockFi offers borrowers a way out. BlockFi lets you take out a USD loan by offering up crypto as collateral to secure the loan.

That is pretty huge for a lot of people. Instead of jumping through the hoops of receiving a stablecoin loan (which you have to convert to cash, then withdraw from an exchange), BlockFi gives you a direct path to the money you need.

You can use three types of collateral on the platform: Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), which are three of cryptoʼs leading digital assets.

Like most crypto lending platforms, BlockFi caps its loan to value ratio at 50%, meaning youʼll need to deposit twice the amount youʼre seeking for the cash loan as collateral.

For example, a $5,000 fiat loan will require you to have $10,000 worth of cryptocurrency to put up as collateral. Getting a crypto-backed loan in this way keeps you safer from the possibility of being margin called while also protecting BlockFiʼs lenders.

BlockFi offers competitive loans without going into reckless maximum LTV ratio offerings. As previously mentioned, the platform allows for no more than a 50% LTV ratio. Thatʼs far more conservative than many home loans in the traditional finance industry, and lower than some crypto loans offering up to 80% maximum LTV ratios.

A lower LTV ratio protects both your collateral and the lender’s assets, thus lowering the likelihood of a margin call on your deposited digital assets. Additionally, the interest rate you will pay starts at a low 4.5%* on loans. Other lending platforms that offer lower interest rates generally donʼt offer USD loans like BlockFi does.

Whereas BlockFi Interest Account clients have BTC, ETH, and GUSD as options for deposits, borrowers have BTC, ETH, and LTC as collateral options.

One place where BlockFi does stumble, however, is its minimum loan amount of $5,000. That figure may be a bit steeper than some would like to see.

In summation, BlockFi loans let you keep your crypto assets while leveraging them to get the cash you need.

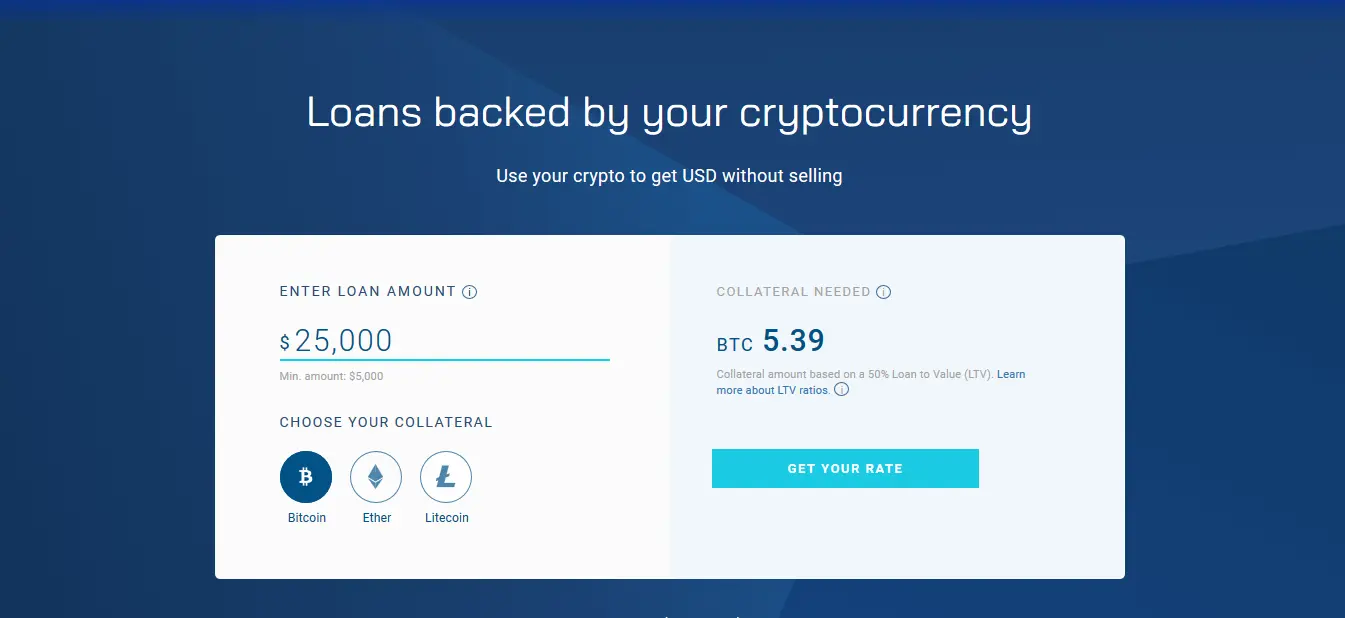

Calculating Your BlockFi Crypto Loan

Letʼs say you want to borrow $25,000 in cash. At a 50% LTV ratio, you will need to deposit 6.13 BTC (based on current BTC prices). All BlockFi loans come with a 12-month loan term.

Youʼll have a monthly payment of $234.38 over 12 months and will pay a total interest amount of $2,812.50. If you deposit more BTC as collateral to lower your LTV ratio to 35% or less, your monthly payment, total interest, and margin call price will all drop significantly.

Create an account to get a free personalized rate based on your loan amount and collateral holdings.

BlockFi Interest Accounts (BIA)

Traditional interest accounts have been standard fare for years. Their rates are so widely accepted that high yield in the traditional banking world means a scant 2% interest per year. While that seems to satisfy most, crypto investors have different needs.

The BlockFi Interest Account is a crypto savings account that pays out up to 8.6%* APY. That figure blows away traditional savings accounts and makes them look cheap by comparison.

For example, American Expressʼ highly rated High Yield Savings Account nets you a measly 0.50%.

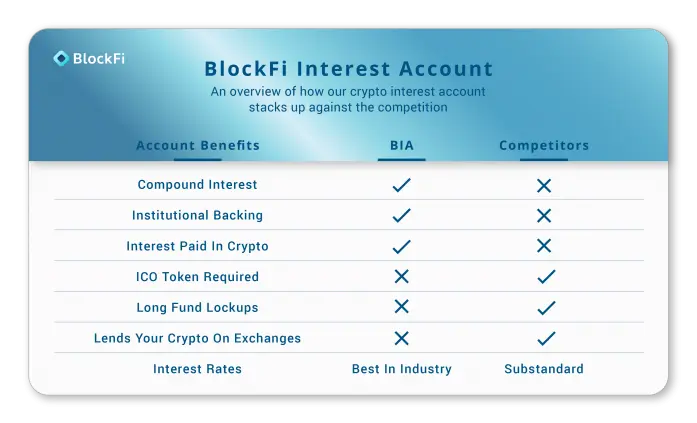

Of course, traditional savings accounts are all about interest on cash deposits. BlockFiʼs savings account is for earning interest on cryptocurrency deposits. Currently, you can deposit BTC, ETH, and GUSD (Gemini Exchangeʼs stablecoin) into your BIA to receive benefits that include compound interest, interest paid in crypto, and no long fund lockups.

The last point is a critical one since comparable products require you to lock your funds into the savings account for months. BlockFi lets you come and go as you please and has no minimum deposit requirements, giving you a high degree of flexibility.

BlockFiʼs compound interest is another nice touch that gives you added ROI as you continue funding your account. You may be (rightly) wondering where that interest is accrued from. BlockFi lends BIA assets to both institutional and corporate borrowers, collects interest from those loans, and pays them back to BIA clients.

BlockFi also offers Interest Payment Flex, which allows you as a crypto investor to select the currency your interest is paid out in to help diversify your portfolio without having to purchase more currencies.

As for BlockFi’s other services, you can find details about its new trading platform here and its institutional offerings here.

How to Use BlockFi

Regardless of whether you want to start a BlockFi Interest Account or simply borrow cash, the starting point is the same.

- Head over to BlockFi’s website and click the ‘Get Started’ button at the top right.

- Fill out a few basics, such as your name, email address, and password, then enter the verification code sent to your inbox. Once done, youʼll be redirected to your profile setup where youʼll be asked to provide additional details like your date of birth, address, and Social Security number (U.S. residents only).

- Next, it is crucial that you click the ‘Securityʼ tab and enable two-factor authentication (2FA). We strongly advise using 2FA any time it is an option, especially on any account that deals with your finances.

After completing your basic profile and enabling 2FA, youʼre ready to get going. At the top-left of your account screen are two tabs –‘Interest Accountʼ and ‘Loans.ʼ

If youʼre starting a BlockFi Interest Account:

Click ‘Interest Accountʼ to be taken to a very user-friendly account screen with a few values. Among those values are an account value display, assets display, transaction records, and two simple buttons for depositing and withdrawing your assets.

Since youʼre just starting out, youʼll click ‘depositʼ to activate the account with either BTC, ETH, or GUSD. The transaction tracker at the bottom will let you know how many confirmations are left before the assets hit your account and begin accruing interest.

If you’re taking out a BlockFi loan:

Click the ‘Loansʼ tab and then go for the ‘New Loan’ button on the right. There, youʼll find details about the loans you qualify for along with a rate calculator that provides all of the details you should know before accepting the loan.

[lender-shortcode lender=”BlockFi”]

BlockFi Reviews Around the Web

BlockFi is rated “Great” on Trustpilot. At the time of writing, however, that is based on only nine user reviews.

That said, people are generally more likely to write a bad review than a positive one, and only one user cited having had a bad experience:

Constant problems with 2FA. Website tells me “code mismatch” but when I refresh the page code was fine and I can continue. Other times I have to try putting 5 codes one by one until one of them works (it’s usually 1 in 5). I’ve been trying AndOTP, FreeOTP and Google Authenticator, all resulted in the same errors. I don’t have this problem anywhere else despite using the same 2FA app everywhere.

— DL, Trustpilot reviewer

It’s worth noting this can be attributed to several factors, like technical or user error, and isn’t necessarily representative of BlockFi’s services. Other users cite having great experiences with BlockFi:

They seem to have some of the best rates for lending out your Bitcoin at the moment. Their website is easy to use and it’s quite clear to see how interest is calculated. They offer great rates on a few different cryptocurrencies. I’ve only been with them for a few months but so far, so good.

— Jason, Trustpilot reviewer

A quick look at Reddit will show you a thread of users with varying experiences:

I’ve had a positive experience with them so far, but they have a lot of room for improvement. The biggest issues I have are their high withdraw fees (0.0025 BTC and 0.0015 ETH) and early withdrawal penalty (if you withdraw before the last calendar day of the month, you will lose all the interest earned on the amount withdrawn). So it takes some planning to make sure you don’t fall prey to these policies.

— joepile, Reddit reviewer

As for the company itself, it is rated 5.0 stars on Glassdoor, but, again, reviews are limited.

FAQs About BlockFi

Below are some common questions about BlockFi’s legitimacy and security.

Is BlockFi Legitimate?

In January 2018, BlockFi closed a seed round for $1.55 million in funding with the principal backer being none other than ConsenSys Ventures. ConsenSys Ventures is headed by Ethereum co-founder Joe Lubin and is widely regarded for its ability to pick out early winners and disruptors in the blockchain space.

Led by Zac Prince and Flori Marquez, the BlockFi team is filled to the brim with FinTech and entrepreneurial all-stars. The team has a collective experience tallied in decades across notable companies that include Merrill Lynch, Bond Street, ESL Investments, and Ubiquiti.

BlockFiʼs advisory board is stacked, too. Chris Ferraro, a partner at billionaire Mike Novogratzʼs Galaxy Digital fund, and Suk Shah, CFO at Avant, a leading digital lender, round out a list of key advisors.

Finally, BlockFiʼs financial backers form an envious whoʼs who list of FinTech, blockchain, and VC bigwigs. Fidelity Investments, Galaxy Digital, Winklevoss Capital, Coinbase, and Morgan Creek all have a stake in BlockFiʼs future. With friends like these, you can rest assured that BlockFi is legitimate and destined for great things.

So far, it seems to be living up to the hype.

Is BlockFi Secure?

Yes! Security is paramount at BlockFi.

“BlockFi is devoted to offering institutional-quality products and services that enable clients to build their wealth. Building wealth comes with the responsibility of safeguarding capital and BlockFi’s withdrawal process was designed to enhance security,” according to a company post.

The site has implemented a withdrawal waiting period of between 24 to 48 hours that protects clients from hacking attempts. This waiting period allows users to quickly respond to fraudulent withdrawal attempts, and the company has plans for additional enhancements and improvements to protect its clients’ crypto holdings.

All BlockFi interest account balances are stored in a Gemini custodial account. This is a regulated, secure, and compliant cold storage system.

“With a Gemini Custody account, customer’s digital assets are segregated, using unique digital asset addresses, which are independently verifiable and auditable on their respective blockchains,” according to the Gemini.

BlockFi also uses two-factor authentication to secure its accounts.

Is BlockFi Insured?

BlockFi is not FDIC or SIPC insured, but its primary custodian and licensed depository trust, Gemini (where all users’ assets are stored), does have digital asset insurance. That means BlockFi user’s digital assets are inherently insured through various third-party underwriters.

“Our policy insures against the theft of Digital Assets from our Hot Wallet that results from a security breach or hack, a fraudulent transfer, or employee theft,” according to the Gemini User Agreement.

You can read more about Gemini’s insurance policy here.

Where is BlockFi Located?

BlockFi is located in New Jersey. Its mailing address is:

201 Montgomery Street

Second Floor, Suite 263

Jersey City, New Jersey 07302

They can be reached by phone at 646-779-9688.

Final Thoughts on BlockFi

BlockFi does a fantastic job of narrowing its offerings to two strong and desirable products. Compared with traditional loan platforms, and even some blockchain FinTech competitors, BlockFiʼs loan rates are reasonable.

Additionally, we like the flexibility offered on BlockFi Interest Accounts. Allowing clients to come and go as they please is the right move, signaling a growing trend among DeFi players to give users more freedom.

Cryptocurrency loans have taken off during the past year, but that has mostly been due to institutional borrowers. With platforms like BlockFi sharpening their skills, we anticipate that 2020 will see more retail-level clients utilizing cryptocurrency loans as a way to get the financing they need.

*Disclaimer: Rates for BlockFi’s products are subject to change, but we do our best to keep these figures current at all times.