Compliance is the watchword of financial regulators around the world. At its core, the entire notion of complying points to following rules.

In the cryptocurrency loan industry, compliance is especially pertinent for financial service providers as well as borrowers and lenders like you. However, because the cryptocurrency industry is only loosely regulated by differing global standards, only two compliance measures have truly proliferated.

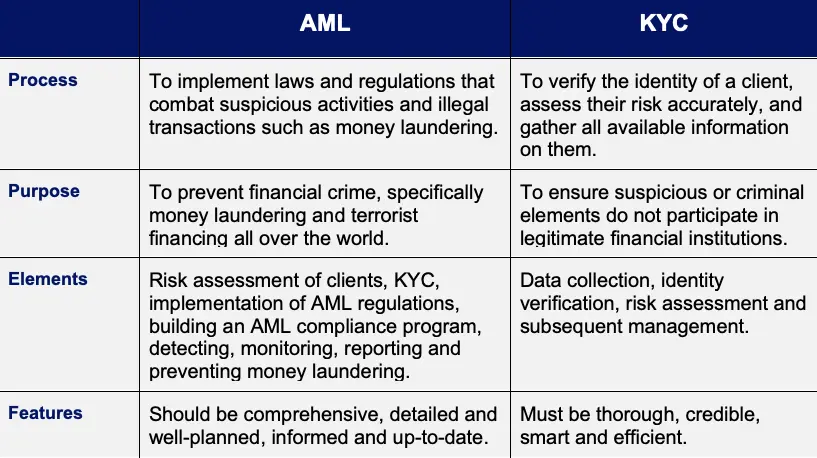

Say hello to KYC (Know Your Customer) and AML (Anti-money Laundering). These two crypto compliance measures are standard across the board for most blockchain financial services.

So, what are they, exactly?

Below you’ll find clear and concise explanations of what KYC and AML are, who needs to comply, and how they affect you as the end-user of decentralized finance (DeFi) services.

What is KYC (Know Your Customer)? It’s an Identity Verification Guideline

Everywhere you go in crypto, you’ll see the question raised — KYC required? Know Your Customer is a guideline used in the financial world that requires service providers to verify client identity.

In the macro sense, knowing who you’re dealing with is vital, so actions and events are traceable back to a known user rather than an anonymous source. Tax authorities and law enforcement are especially keen on KYC compliance measures because they link financial accounts with real people, enabling financial oversight and evidence gathering if needed.

Crypto Loan Companies & DeFi Platforms Require KYC to Keep the Bad Guys Out & Your Funds Safe

Cryptocurrency lending platforms and DeFi services require KYC to keep known criminals and blacklisted users out. Keeping prohibited players out of the game means exchanges, lending platforms, and DeFi products are safer to use for everyone else.

Without KYC regulations, current and prior financial criminals could easily circulate among retail users on platforms like BlockFi and create problems. By keeping unwanted elements out of these services, compliant crypto loan companies are essentially protecting your funds as well as their integrity.

While some DeFi loan companies back their Bitcoin savings accounts with insurance policies, not all of them do — and nobody wants matters to escalate that far in the first place. KYC keeps everyone above water and on a level playing field where all identities are known.

How AML Differs From KYC

Even though you usually hear AML (Anti-Money Laundering) and KYC used in the same sentence, they do have key differences.

AML compliance regulations are largely in place as counter-terrorism measures. To prevent both wide and small-scale money laundering by organized crime operations, AML processes are enforced by most financial services.

The difference between KYC and AML is that the former is the specific tool used to feed data to the latter. In other words, AML is the process, but KYC is the actual mechanism being used by crypto loan platforms and their customers.

AML compliance is something financial companies deal with on the back-end. They’re required to submit risk analysis reports to financial oversight regulators and are tasked with doing due diligence on new customers.

Penalties exist for companies that fail to submit AML reports, meaning they rely heavily on KYC measures to cull the identity data needed to create the reports.

Should I Use a Crypto Lending Platform If It Doesn’t Require KYC?

Not all cryptocurrency loan platforms require KYC — especially if they’re decentralized finance platforms.

The reason is simple: decentralized finance platforms use smart contracts to perform financial services on blockchains directly between users anonymously. Since these DeFi protocols are handled in their entirety by mathematics–not people–there’s no one to submit AML reports or comply with KYC measures.

Are you putting yourself and your funds at risk by using non-compliant DeFi lending products?

The answer is a complicated one. For the moment, the regulation surrounding DeFi products is murky. Whether AML and KYC measures apply to decentralized financial protocols like Compound and Aave is unclear, especially since these are trans-national protocols.

As such, the best advice anyone can give you regarding the legal standing for using these protocols is to do so at your own risk. Smart contract held and operated DeFi loans and Bitcoin savings account security differs greatly depending on the platform.

Compound and Aave are two DeFi lending platforms that do not require KYC and have strong reputations for performance and security. Sticking with a known company rather than going down the rabbit hole of experimental DeFi protocols is your best bet for maintaining the safety of your funds.