SALT Lending (Secure Automated Lending Technology) is a crypto loan platform that offers crypto-collateralized loans for borrowers. The company, based out of Colorado, was founded in 2016 by its CEO, Shawn Owen, along with other “bitcoin enthusiasts” as a way to push for the future of money.

While it is difficult to say if SALT was the first to market with a crypto-collateral loan structure, they are certainly among the first to develop the model. Not only did SALT build an early crypto loan platform, but it did so with sophistication.

The loan process on SALT is uniformly enforced using smart contracts while the loans themselves are offered with jurisdictional licensing in most states and in nine other countries. Apart from the UK, Europe is not covered by SALT, but the company says it has plans to expand to other countries later on.

How Does SALT Lending Work?

SALT offers a very straightforward product—crypto-backed cash loans. Say you want to borrow $50,000. With SALT Lending, youʼll choose your LTV ratio (anywhere between 30% – 70%), a repayment option, and a loan duration (3 to 12 months), and youʼre all set.

If you go with a 50% LTV, interest-only repayment, and a 12-month duration, you will need to deposit $100,000 worth of collateral. Additionally, you will have to redeem 833 SALT tokens to activate the loan.

All told, your loan will cost $57,183 ($7,183 interest) at an APR rate of 12.95%. Monthly payments of $529 are required before the final payment of $50,529.

If that seems a bit high to you, thatʼs because it is. A nearly 13% APR rate isnʼt very competitive with other platforms like Nexo or BlockFi.

You can, however, lower that rate by redeeming more SALT. With the SALT token currently valued at $0.07 on the open market, accumulating it to put toward your loan shouldnʼt be too costly.

Getting SALT tokens in the first place may be a big ask, though. It was recently delisted from both Binance and Bittrex, its two most liquid markets.

Along with other blockchain loan companies, zero credit checks are required to obtain a loan. In fact, apart from KYC and AML requirements, you donʼt have to prove anything except that you own enough crypto to back your loan.

SALT loans happen in three simple steps:

1. Collateralize your loan

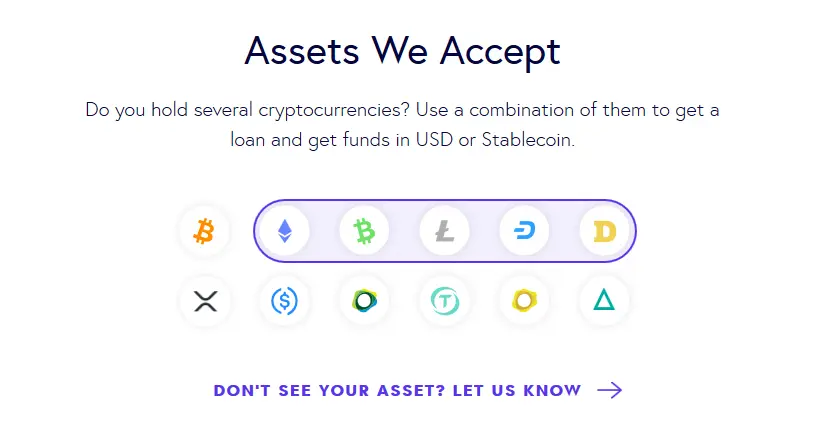

The first step is to deposit your collateral using any of SALT’s accepted digital assets. Current eligible collateral includes Bitcoin (BTC), Bitcoin Cash (BCH), Ether (ETH), Litecoin (LTC), Dogecoin (DOGE), Dash (DASH), TruUSD (TUSD), USD Coin (USDC), Paxos Standard Token (PAX), PAX Gold (PXG) and XRP.

Once done, your SALT Wallet will automatically recognize the value and make you eligible for a loan.

2. Repay your loan

You can choose a loan duration of between three and 12 months. During that time, you’ll be required to make fixed monthly repayments.

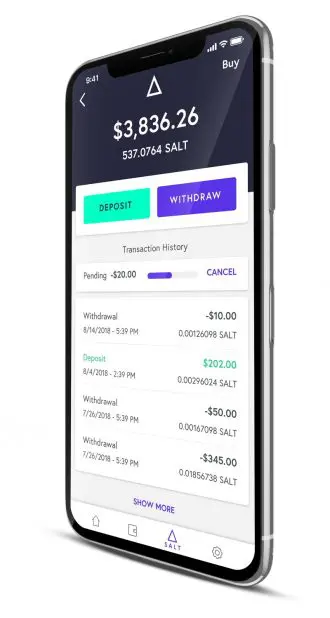

Always paying on time keeps your loan in good standing, which you can manage in the SALT Lending app.

3. Finish your loan

Once you make your final repayment at the end of your loan term, the total sum of your collateral is returned to you. That’s it!

[lender-shortcode lender=”Salt Lending”]

SALT Oracle Explained

Central to the value provided by the SALT Lending team is the SALT Oracle. In effect, the Oracle is both the brain and guarantor behind every loan on the platform. Each time an action occurs—whether that is starting a loan, depositing collateral, or repaying a loan—the Oracle creates a smart contract and updates it in real time.

You can witness the progress of your loan owing to the Oracleʼs diligence in keeping it current. When you make payments, or the value of your collateral rises or falls, the Oracle updates the loan contract so that you can monitor its health in the app.

The SALT Oracle provides tons of user-utility since it gives you a clear and present view of exactly how your loan is performing and what you need to do, if anything. In some market conditions, crypto volatility will be such that the value of your collateral may drop, thus triggering a margin call event.

Your loan status will immediately reflect the change once updated by the Oracle, passing the warning on to you. You’ll receive the notification by text, email, and app status update. A variety of notification updates gives you ample opportunity to either deposit more collateral or run the risk of your LTV plummeting further.

The (Rocky) History of SALT Lending

SALT Lending made a big splash in 2017 when it announced its $50 million ICO to the world. At the time, it was the first well-known crypto lender making a foray into the decentralized-finance (DeFi) loan industry with a blockchain-based solution.

The SALT ICO was a success, and SALT token values subsequently skyrocketed to over $17. At the time of writing, however, SALT tokens are worth just over $0.07.

While the entire cryptocurrency market has dropped since 2017, SALT took an especially sharp decline after a few issues plagued the crypto loan startup, including getting in hot water with the SEC over its ICO, and a vague membership model that failed to attract users to its platform.

In 2018, SALT Lending appeared to go offline entirely, with most of its social media accounts either going dark or inactive. It turns out that during that period, it was undergoing a formal restructuring.

The company reworked its membership model, opening the platform to non-members and giving SALT holders the opportunity to stake the token for better interest rates. After another year, that model also failed to attract value to the SALT token, as represented by further declines to the tokenʼs worth.

In September 2019, SALTʼs leadership decided to go for yet another restructuring. This time, the SALT tokenʼs staking feature was shelved in favor of a redemption model.

Rather than gain lower APR rates from staking SALT, members are now able to redeem their SALT upfront as a credit toward the collateral needed to secure a loan.

Salt Lending Reviews Around the Web

A quick web search will show varying user experiences with the company. However, many of the reviews are kind of dated and seem to address the Salt token more than the service itself.

Some digging on Reddit turned up some reviews about the loans:

“Recently took out loan. Also staked SALT to lower rate. Super happy so far, You guys have built an awesome platform.”

— General_Illus, Reddit Reviewer

SALT is rated 4.1 out of 5 on its Facebook page, currently based on 63 users. The biggest complaint seems to be around lack of communication:

“Invest in some customer service and stop counting the money – rude not to reply 4 weeks 2 emails no reply.”

— Ari V., Facebook Reviewer

The company also boasts an A+ rating with the Better Business Bureau, though it is not BBB accredited. It also claims to have a 92% customer satisfaction rating on its website, though it’s unclear where that figure comes from.

FAQs About SALT Lending

Here are some frequently asked questions about SALT Lending and its services:

What is SALT Membership?

There appears to be conflicting information regarding SALT membership. Do you need a membership to get a SALT loan? The answer is yes, sort of.

Back in the day, SALT required you to purchase one of three membership tiers. The most basic only required an investment of one SALT membership unit and offered members basic USD cash loans. The other two tiers of membership opened loan opportunities up to other fiat currencies and offered better rates.

By 2018, SALT had done away with that model and replaced it with staking. The more SALT you staked, the better your loan terms were. Now, however, staking has been replaced with redemption.

In effect, there are two SALT loan services. The first requires no SALT; the second requires borrowers to redeem SALT.

If you go with the former, your loan terms won’t be too favorable. Compared to the APR offered at competitors like BlockFi, SALT hits “free” users pretty hard. However, the redemption model does drop your APR considerably if you redeem over 1,000 SALT.

Is SALT Lending Safe?

SALT Lending takes great measures to ensure the safety of its users’ data and holdings. According to SALT, “All website traffic is TLS (SSL) protected with industry-standard RSA 2048 encryption. All members are required to enable 2-Step Verification and your account cannot be accessed without your 2-Step credentials. Employee access to Member data is strictly limited. We’ve engaged an independent third party to perform a recurring security review.”

Furthermore, all funds are insured against fraud and theft in the unlikely event a hack takes place. “SALT’s crime insurance is underwritten by various Lloyd’s of London syndicates currently holding A+ ratings from S&P,” according to its website.

You can read more about SALT’s security measures here.

Where is SALT Lending Located?

According to the SALT website, “SALT is incorporated in Delaware, with operational and development offices and entities located in Colorado and Mauritius. Our expansion plan includes offices in Europe and Asia.”

Its corporate mailing address is:

SALT Blockchain, Inc.

P.O. Box 8350

Denver, Colorado 80201-9998

Final Thoughts on SALT Lending

SALT has quite a few things going for it. It has history and experience in the industry, a solid team that has been working on the product for years, and a degree of brand name recognition in crypto circles. Additionally, the team raised a staggering $50 million sum before the crypto bull run of 2017–2018, so they should be sweet in terms of financial runway.

These issues may overshadow what is essentially a very straightforward product. Their membership model hasn’t done the platform any favors, either. Using a membership model does nothing but complicate the product, and comes across as an after-the-fact way of providing utility to a token that didn’t need to exist.

All these changes in such a short period have given many users a sense of uncertainty surrounding the companyʼs future. But despite its travails, SALT Lending is still one of the most recognized names in the crypto loan industry. For an earlier generation of cryptocurrency holders, its name is even synonymous with crypto lending itself.

Given that status, itʼs essential to dig into the SALT Lending platform to determine whether it is still a good option for those seeking a crypto loan. With the sheer number of options in the industry today, it just may be that SALT still has something to offer.